U.S. Shares Finish Week within the Purple Regardless of Friday Rally

U.S. shares wrapped up the week with losses, whilst a Friday rally supplied a brief increase. The markets have struggled heading into the vacation season, dealing with headwinds from financial information and coverage uncertainties.

December Struggles Dampened Rally Momentum

An early December shift triggered what Mark Hackett, chief market strategist at Nationwide, referred to as a “breakdown in breadth” within the U.S. inventory market. November’s sturdy efficiency might have pulled ahead beneficial properties that usually happen throughout the “Santa Claus rally,” Hackett mentioned in an interview.

“I don’t really feel snug that the normal Santa Claus rally goes to return,” he added.

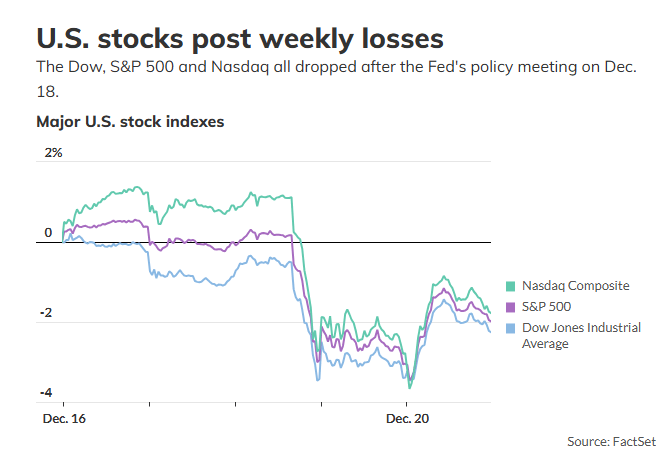

The Dow Jones Industrial Common (DJIA) erased most of its quarterly beneficial properties, dropping 4.6% in December. The S&P 500 (SPX) posted back-to-back weekly losses, whereas the Nasdaq Composite (COMP) ended a streak of 4 consecutive weekly beneficial properties, in response to Dow Jones Market Information.

Fed Coverage and Financial Uncertainty

This week’s market stumble adopted indicators from the Federal Reserve that its projected price cuts in 2025 may be much less aggressive than beforehand anticipated. Issues about sticky inflation and a narrowing market breadth have tempered optimism that accompanied November’s rally.

Seasonal Buying and selling Patterns

The S&P 500 has traditionally gained 1.29% on common throughout the seven-session “Santa Claus rally” interval, which begins Christmas Eve. Nonetheless, final yr noticed a 0.9% decline throughout this stretch, and present market circumstances counsel a repeat efficiency may very well be on the horizon.

Inflation Information Brings Short-term Reduction

On Friday, markets rallied after November inflation information confirmed a smaller-than-expected improve within the private consumption expenditures (PCE) value index. The Dow surged 1.2%, marking its largest one-day achieve since November, whereas the S&P 500 and Nasdaq rose 1.1% and 1%, respectively. Regardless of the rally, the Dow fell 2.3% for the week, the S&P 500 dropped 2%, and the Nasdaq declined 1.8%.

Large Tech Takes a Hit

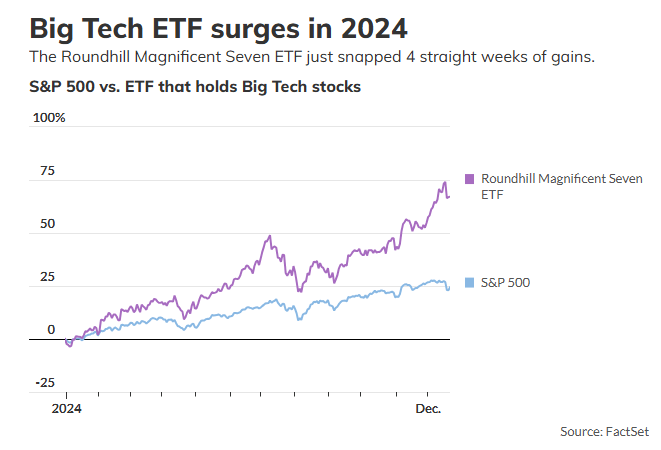

Large Tech shares, which have pushed a lot of 2024’s market beneficial properties, delivered blended performances. The Roundhill Magnificent Seven ETF (MAGS), providing equal-weight publicity to Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla, and Meta, ended the week down over 1%, snapping 4 weeks of beneficial properties.

Coverage Issues Linger

Market sentiment stays clouded by uncertainty over authorities spending, commerce, and immigration insurance policies anticipated in 2025 below the brand new administration. Analysts concern aggressive commerce measures or immigration reforms may exacerbate inflation and hinder progress.

A Sturdy 12 months Faces a Weak End

Regardless of December’s losses, 2024 has been a stellar yr for shares. The Nasdaq has climbed 30.4% year-to-date, whereas the S&P 500 is up 24.3%, and the Dow has gained 13.7%. The S&P 500 stays 2.6% beneath its December 6 file excessive, with analysts predicting muted efficiency for the rest of the yr.

“There’s loads of optimism already priced into shares,” mentioned Anthony Saglimbene, chief market strategist at Ameriprise Monetary. “We’ve had a extremely sturdy yr available in the market.”