The Dow Jones Industrial Common entered December hoping for a “Santa Claus rally” to offset an already difficult month, however Wall Avenue’s seasonal cheer did not materialize for the second consecutive 12 months.

By the top of December, the Dow had dropped about 5.3%, its worst month-to-month efficiency since September 2022 and its weakest December since 2018, in accordance with Dow Jones Market Knowledge. In distinction, the S&P 500 declined a extra modest 2.5%, whereas the tech-heavy Nasdaq Composite managed a 0.5% achieve, leaving the Dow lagging behind.

A Rally That Misplaced Steam

December’s struggles adopted a powerful post-Election Day rally, which had pushed the Dow above the 45,000 mark for the primary time on December 4. “We’ve had a fairly super run-up,” mentioned Charlie Ripley, senior funding strategist at Allianz Funding Administration, noting that the rally might have set the stage for a pure pullback.

Regardless of preliminary beneficial properties, the Dow started slipping in early December. Whereas the S&P 500 held comparatively regular and the Nasdaq continued climbing, all three indexes tumbled on December 18 after a Federal Reserve assembly.

Though the Fed introduced one other fee minimize, Chair Jerome Powell’s feedback dampened market sentiment. He projected solely two 25-basis-point fee cuts in 2025 and emphasised that inflation may stay sticky, which displeased buyers.

“We acquired that destructive shock from Powell,” mentioned Steve Sosnick, chief strategist at Interactive Brokers. Despite the fact that Powell’s remarks have been largely according to expectations, they have been extra hawkish than hoped by the market’s most bullish members.

Skinny Vacation Buying and selling and Exaggerated Strikes

The destructive sentiment spilled into the usually low-volume vacation buying and selling interval, exacerbating inventory actions. Traditionally, the vacation season is favorable for shares, however thinner liquidity this 12 months amplified declines.

“If individuals are taking some chips off the desk, you are likely to see these strikes slightly bit extra exaggerated,” Ripley defined.

Why Did the Dow Undergo Extra?

The Dow’s underperformance stemmed largely from its construction and composition. In contrast to the market-cap-weighted S&P 500 and Nasdaq Composite, the Dow is a price-weighted index, that means higher-priced shares exert extra affect.

This dynamic performed out in December, as beneficial properties in Apple (+4%) had much less affect than losses in Microsoft (-2%). In the meantime, standout performances from tech giants like Alphabet (+10%) and Tesla (+16%), neither of that are within the Dow, drove the Nasdaq greater.

“Tech is driving the bus,” Sosnick mentioned. “Tech wins, the markets go up. Tech loses, the markets fall. And the Dow is just not a tech-based index.”

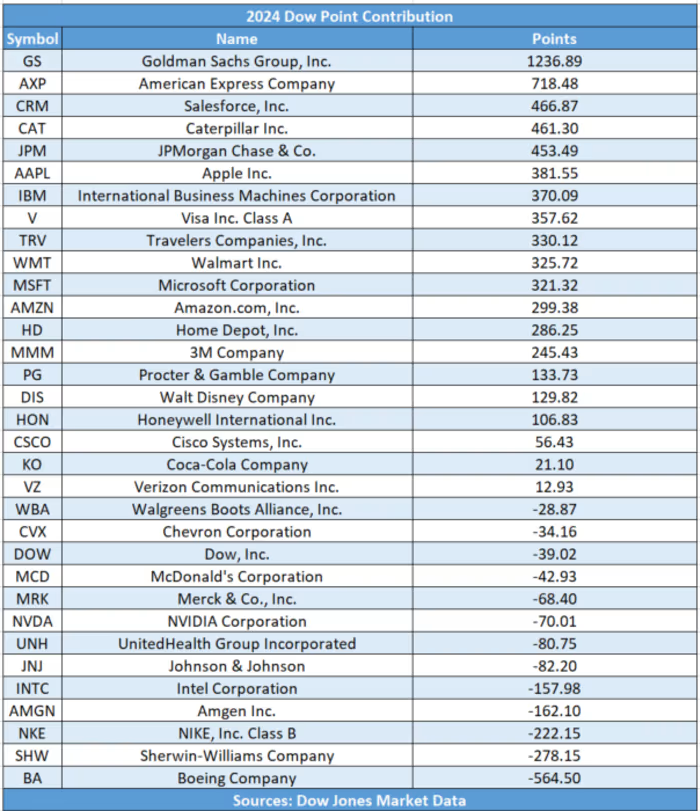

The Dow additionally confronted idiosyncratic dangers. UnitedHealth Group, a high-priced inventory and the index’s second-largest part, struggled after the sudden loss of life of its CEO, Brian Thompson, on December 4. Different blue-chip shares, together with Caterpillar, Dwelling Depot, and Sherwin-Williams, posted vital declines.

A Combined Bag for 2024

Regardless of its December stoop, the Dow ended 2024 with a 12.9% achieve and has climbed 28.4% over the previous two years. Nonetheless, this efficiency pales in comparison with the S&P 500’s 53.2% and the Nasdaq’s 84.5% over the identical interval.

The Dow’s uneven December underscores the significance of viewing it as only one measure of market efficiency. As Ripley famous, “There could also be months when the Dow is out of sync with the opposite indexes.” For buyers, diversification stays key in navigating such disparities.