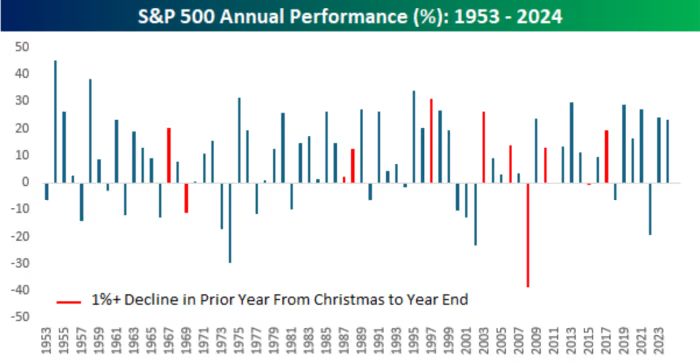

The ultimate days of 2024 delivered a traditionally poor market efficiency for the S&P 500, in keeping with Bespoke Funding Group, capping off an in any other case robust 12 months on a bitter word.

U.S. shares started 2025 on shaky floor, with the S&P 500 SPX -0.22% dipping 0.2% on Thursday, the 12 months’s first buying and selling session. This adopted a 2.6% decline from the shut on Christmas Eve via the tip of 2024—marking “the worst year-end efficiency since at the least 1952,” in keeping with a Bespoke word shared Thursday.

“December wasn’t month for bulls,” Bespoke famous, including, “and the final a number of days had been dangerous to a historic diploma.”

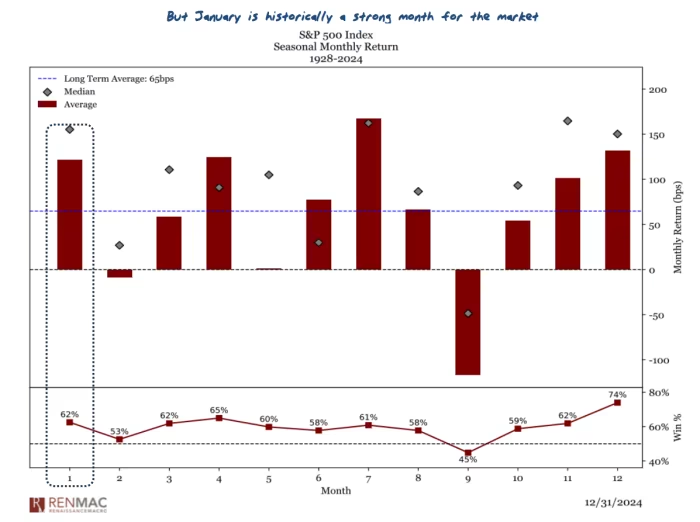

Regardless of this tough end, Bespoke emphasised that it doesn’t essentially sign hassle for 2025. Traditionally, the S&P 500 has typically rebounded following year-end declines exceeding 1%. January, particularly, has been a powerful month for the index, with Renaissance Macro Analysis highlighting it as a historic standout when it comes to common returns since 1928.

Traders are additionally maintaining a tally of the “Santa Claus rally” window, which historically spans the ultimate 5 buying and selling days of the 12 months and the primary two of the brand new 12 months. Whereas the S&P 500 fell 1.6% over the past 5 classes of 2024, the rally’s destiny stays unsure, with the interval ending Friday.

On Thursday, broader U.S. markets mirrored the S&P 500’s retreat. The Nasdaq Composite COMP -0.16% declined 0.2%, whereas the Dow Jones Industrial Common DJIA -0.36% slipped 0.4%. Regardless of the late-year stumble, the S&P 500 ended 2024 up 23.3%, underscoring its general power through the 12 months.