Be Cautious When Market Timer Keep Bullish After a Huge Downturn

Latest market habits highlights the significance of sentiment evaluation amongst stock-market timers. By decreasing fairness publicity and increase money reserves, timers are signaling a possible short-term enhance for the bull markets.

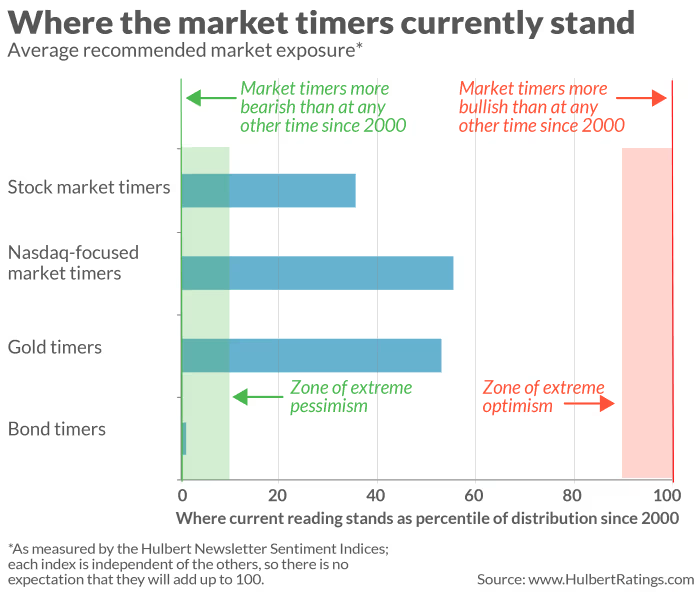

A contrarian evaluation reveals a stark shift in market-timer sentiment. In early December, exuberance amongst timers reached excessive ranges, as measured by the Hulbert Inventory E-newsletter Sentiment Index (HSNSI), which hit a document excessive of 92.8%. Such a peak typically foreshadows markets pullbacks, and the December turbulence was no exception. Since then, the HSNSI has plummeted 63 proportion factors to 29.3%, marking a dramatic change in sentiment.

This sharp discount in fairness publicity contrasts with the cussed bullishness usually seen at main market tops. Traditionally, through the early levels of bear markets, timers have a tendency to carry onto optimism, typically rising fairness publicity regardless of indicators of bother. For instance, through the web bubble burst in March 2000, market timers grew to become much more bullish after an preliminary 10% decline—setting the stage for a chronic downturn.

The present sentiment, nonetheless, displays cautious and even bearish positioning, which contrarians interpret as a wholesome signal for the market’s resilience. The absence of unshakable optimism means that the bull markets should still have life left.

Sentiment in Different Markets

Whereas stock-market sentiment grabs consideration, sentiment in different asset lessons additionally warrants consideration. My agency tracks sentiment indexes for Nasdaq-focused shares, gold, and U.S. bonds.

Notably, the bond sentiment index has fallen to ranges similar to the HSNSI’s euphoric December peak—however in reverse. This excessive bearishness on bonds suggests the near-term outlook for fixed-income investments could also be higher than extensively assumed.

In abstract, it’s clever to stay alert when timers show unyielding optimism after a downturn. Historical past reveals that such stubbornness typically precedes vital markets declines. Conversely, the present cautious stance amongst stock-market timers may present the inspiration for additional markets stability within the close to time period.