The U.S. inventory market expanded its rally this week, with all S&P 500 sectors posting features, as declining bond yields supplied reduction from their latest sharp rise.

The S&P 500, Dow Jones Industrial Common, and Nasdaq Composite all recorded weekly features, pushing every index into constructive territory for January, based on FactSet. The S&P 500 and Dow logged their strongest weekly performances because the week of Donald Trump’s 2016 presidential victory.

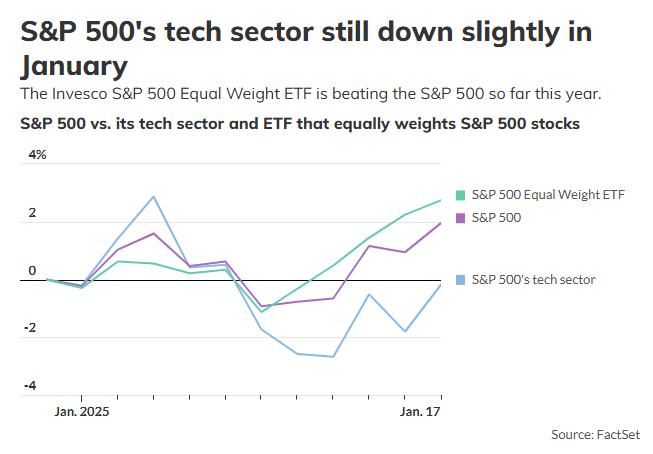

“What’s encouraging is that the equal-weighted S&P is main,” famous Louis Navellier, Chief Funding Officer of Navellier, in a Friday e mail. This alerts a broadening of the inventory market’s advance, additional supported by a major pullback in rates of interest.

An exchange-traded fund monitoring the equally weighted S&P 500 outperformed the standard index, which is closely influenced by Large Tech megacaps. After a unstable begin to 2025, marked by spiking Treasury yields, the market’s rally is displaying broader participation forward of Donald Trump’s inauguration.

Financials, vitality, and supplies led the S&P 500 sectors this week, every gaining about 6%, FactSet knowledge present. Financials, particularly, surged as main banks reported sturdy This autumn earnings, with Citigroup, Goldman Sachs, and Morgan Stanley every rallying round 12%.

“The banking sector continues to commerce at a major low cost to the broader S&P 500 regardless of latest features,” mentioned Chris Davis, chairman of Davis Advisors, in a cellphone interview. Davis, who manages the Davis Choose Monetary ETF, famous that traders are optimistic about potential deregulation below the incoming administration, which may cut back “regulatory complexity” for banks.

Friday marked the ultimate buying and selling session below President Joe Biden, with Trump’s inauguration scheduled for Monday. Markets will shut in observance of Martin Luther King Jr. Day.

U.S. inventory indexes ended increased Friday, with the Dow up 0.8%, the S&P 500 rising 1%, and the Nasdaq advancing 1.5%. Treasury yields retreated, with the 10-year yield seeing its largest weekly drop since late November after cooler-than-expected December inflation knowledge.

The S&P 500 rose 2.9% for the week, up 2% in January, whereas the Invesco S&P 500 Equal Weight ETF climbed 3.9%, bringing its year-to-date acquire to 2.7%. In the meantime, the Russell 2000 small-cap index jumped 4% this week, now up over 2% for the 12 months.

Falling bond yields eased strain on extremely leveraged small-cap companies and supported elevated price-to-earnings multiples, mentioned Navellier. “This discount in rates of interest is offering crucial reduction to the market’s broader restoration,” he added.