The beginning of President Donald Trump’s second time period has fueled a vigorous rally, propelling the S&P 500 to new file highs and pushing market valuations to notable extremes.

This surge has prompted buyers to think about whether or not there are extra inexpensive options to the outstanding megacap expertise shares, which can nonetheless profit from the president’s preliminary coverage strikes.

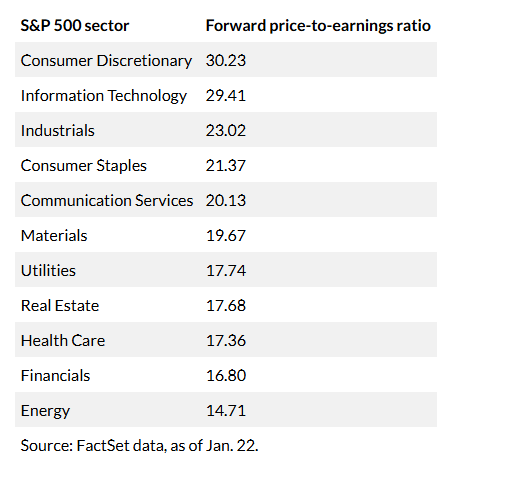

As of this week, the ahead price-to-earnings (P/E) ratio of the S&P 500 climbed above 22, nearing its highest degree in almost 4 years. The final time it crossed this threshold was in November, when it reached 22.34—the height since December 2020, in keeping with Dow Jones Market Information.

The P/E ratio, a metric that compares an organization’s inventory worth to its earnings per share, alerts how costly a inventory is likely to be relative to its profitability. A excessive P/E can point out overvaluation and warning buyers to tread rigorously.

JPMorgan Chase CEO Jamie Dimon highlighted these valuation issues, noting that present asset costs rank among the many prime 10-15% in historic phrases, showing “sort of inflated by any measure,” he instructed CNBC on the World Financial Discussion board in Davos, Switzerland.

Given these elevated ranges, market analysts counsel that buyers look towards much less speculative however basically robust alternatives poised to thrive underneath Trump’s insurance policies, supported by a strong U.S. financial system and rising enthusiasm for synthetic intelligence.

Exploring High quality Options

Mark Luschini, chief funding strategist at Janney Montgomery Scott, identified that the “Magnificent Seven” megacap shares could stay leaders, however the broader market—the “S&P 493”—presents compelling prospects as earnings development in these lagging shares is anticipated to speed up.

Promising Sectors:

Financials: The monetary sector stays enticing, bolstered by expectations of elevated financial institution mortgage exercise and development in mergers, acquisitions, and IPOs. This sector, which gained considerably in 2024, continues to profit from Trump’s deregulatory stance geared toward fostering monetary business enlargement.

Industrials: Industrial shares are gaining momentum, with Wall Avenue anticipating double-digit earnings development in 2025. Moreover, financial stimulus measures in China are anticipated to help corporations inside this cyclical sector.

Utilities: The utilities sector additionally appears to be like promising, supported by the administration’s $500 billion Stargate initiative geared toward boosting AI infrastructure, which is projected to drive a surge in electrical energy demand.

Excessive Valuations Persist for Large Tech

Regardless of their elevated valuations, megacap tech shares are prone to stay a key driver of market positive aspects in 2025. The “Magnificent Seven” are projected to maintain fast earnings development, though at a barely slower tempo than in earlier years.

Based on Luschini, whereas megacap tech stays enticing, the broader market’s anticipated earnings development of 15% in 2025 should materialize for shares to advance. This development is especially essential on condition that market multiples are beginning the yr at traditionally excessive ranges.

Katie Nixon, CIO at Northern Belief, warns that the lofty valuations could face headwinds from larger rates of interest, probably tempering positive aspects from earnings development.

Market Snapshot

As of Thursday afternoon, U.S. shares confirmed blended efficiency. The S&P 500 edged up 0.2% to a file excessive, whereas the Dow Jones Industrial Common gained 0.8%. Nonetheless, the Nasdaq Composite slipped 0.2%, in keeping with FactSet information. In the meantime, President Trump’s advocacy for decrease rates of interest and diminished oil costs continues to affect investor sentiment.