Tech Firms Ramp Up Inventory Buybacks Amid Excessive Vitality Calls for

Tech corporations have considerably elevated their inventory buybacks applications, a development that aligns with broader trade dynamics however raises questions on useful resource allocation in an energy-intensive sector.

The drive for technological innovation, notably in synthetic intelligence (AI) and cloud computing, calls for huge quantities of power to energy information facilities and preserve cutting-edge infrastructure.

Throughout Donald Trump’s second time period, the administration emphasised “America First” insurance policies, specializing in deregulating the power and mining industries whereas encouraging home manufacturing. These priorities aimed to revitalize conventional industries by decreasing prices and leveraging considerable power.

But, for this imaginative and prescient to succeed, specialists at TS Lombard argue that main U.S. firms have to shift their capital investments away from shareholder rewards like inventory buybacks and dividends and towards infrastructure, gear, and technological developments.

Steven Blitz, chief U.S. economist at TS Lombard, highlighted the stress: “The problem is to stability short-term shareholder returns with long-term investments that drive sustainable progress.”

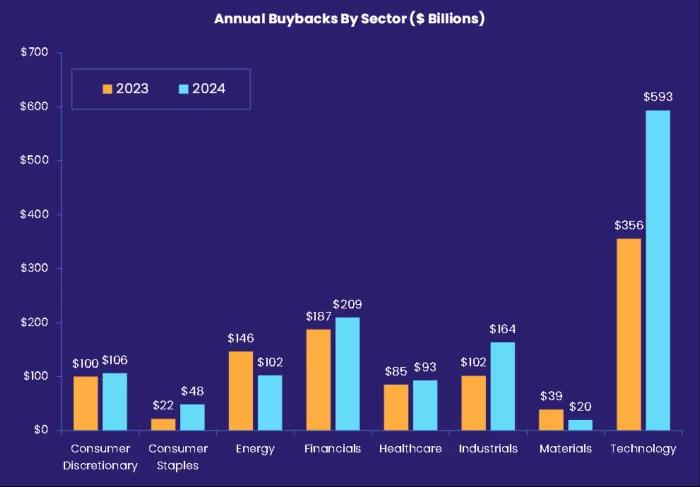

Firms within the S&P 500 introduced a record-breaking $1.34 trillion in deliberate buybacks final yr, diverting almost 70% of inner funds towards capital returns fairly than growth-oriented expenditures.

The tech sector has led the cost in buybacks since 2023, supported by strong inventory market efficiency. Concurrently, these corporations are racing to dominate AI, which intensifies their power calls for.

Blitz and his colleagues at TS Lombard recommend that the administration’s push for power infrastructure enlargement may not directly profit tech giants. A broader power buildout would possibly assist the data-center progress essential for the U.S. to keep up management in rising applied sciences and financial affect.

Because the economic system evolves, balancing capital allocation between shareholder incentives and long-term investments will probably be important. Whereas buybacks improve inventory valuations within the brief time period, the tech sector’s power dependence underscores the necessity for strategic investments in sustainable progress and infrastructure.