Inventory merchants have grown more and more bullish and complacent—and that’s a bearish sign.

A recent concern on the inventory market’s horizon is the brand new all-time excessive of the CBOE’s SKEW Index. Whereas many analysts interpret this rise as an indication that merchants consider a Black Swan occasion, equivalent to a crash, is now extra probably, this view misreads the implications of the SKEW Index.

If this had been true, it might counsel that Wall Avenue’s irrational exuberance is waning, which might be a optimistic improvement for contrarian buyers.

In actuality, the brand new excessive within the SKEW Index indicators the alternative—it means merchants have grown much more bullish than earlier than, which is a bearish signal from a contrarian perspective.

To know why, let’s take a look at how the SKEW Index is calculated. Though the mathematics is advanced, the index basically measures the hole between the consensus view of most merchants and the outlook of a small, super-bearish minority. When this hole widens, the SKEW index rises.

There are two methods this hole can develop. The primary is when the super-bearish minority turns into much more bearish, whereas the consensus view of most merchants stays the identical. That is the interpretation most commentators counsel, claiming that the rise in SKEW signifies rising fear a couple of market crash.

The second, much less acknowledged manner for the SKEW to rise is when the bearish minority stays regular, however the majority of merchants develop much more bullish. On this case, a better SKEW doesn’t mirror elevated concern a couple of crash, however fairly a diminishing sense of fear among the many majority of merchants.

The implications of those two situations are very totally different for buyers.

There are two key the explanation why the SKEW’s new excessive truly signifies much less concern a couple of market crash.

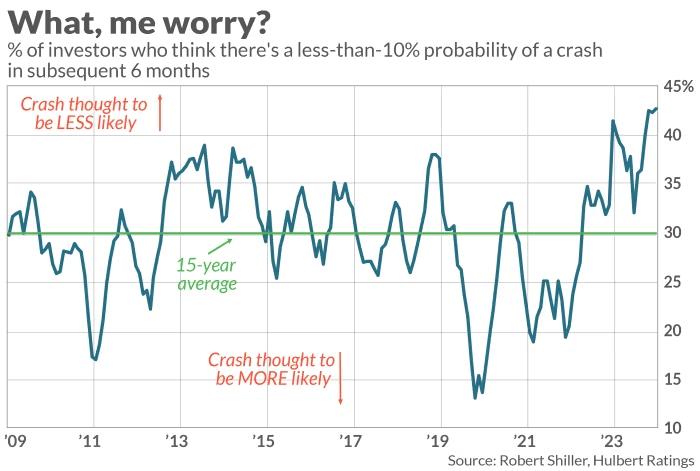

First, the Yale College “U.S. Crash Confidence Index,” carried out by Robert Shiller, exhibits that particular person buyers are actually much less involved a couple of crash than at any time within the final 15 years. It appears contradictory for the SKEW Index to sign heightened crash issues whereas Shiller’s knowledge exhibits the alternative.

Second, the SKEW index has traditionally risen in tandem with bull markets. Because the market climbs, the consensus view amongst merchants turns into extra bullish, widening the hole between the bulk’s expectations and the views of the bearish minority. This relationship between bull markets and a rising SKEW index is backed by a robust 56.3% correlation during the last 15 years, displaying that the SKEW index sometimes will increase during times of market progress.

In conclusion, regardless of some claims, Wall Avenue isn’t involved a couple of market crash. And that needs to be a trigger for concern.